A friend of mine began his search for a Porsche a few months ago with a reasonable budget of $90-100k including repairs to get the car to be a highly presentable, safe driver.

He had driven my 137k mile 964 factory turbo look a few years ago that had gone through the works to become a guilt-free driver which inspired him to find something similar for himself.

When he contacted me to keep my eyes open, the first car I had found was on the Pelican Parts forum. It was a blue on terra cotta combo with 120k miles with an asking price of $80k.

When we did a Google search with the VIN, we found the car had been sold on Bring-A-Trailer about a year earlier with A LOT of questions regarding its history and provenance. After careful examination of the photos on BAT and photos provided from the seller through Pelican, it appeared the owner did little work to the car aside from color dyeing the driver seat.

To get to the quality of car he wanted, at minumum the rear bumper needed to be replaced as it was cracked in a few places, then repainting front and rear bumpers, refinishing wheels, new tires, and replacing the carpet in the driver footwell. Roughly this work would cost around $7k, and that’s without knowing what else would be found in a PPI. Add shipping, an iffy past history and the unknown, and the car was a no go in my book. So we looked on.

A few months passed with his being outbid on nice looking drivers on BAT, losing out to an Internet buyer for a dealer car, and seeing a few dogs at smaller indie dealers. One dealer had the nerve to fix a leak found during the PPI and then proceed to raise the price. As you can imagine, my friend’s frustration with finding a 993 was growing.

One morning I looked at my email and found the blue 993 listed months ago on Pelican Parts was now on auction at PCarMarket! I sent him the link half joking thinking this guy couldn’t get any buyers with a standard listing so now is listing it to an open market auction. I’m sure he didn’t list it at BAT because of how badly it got roasted when it was originally sold there.

But my friend kept this car bookmarked and eventually decided to bid and win the auction. I think he was feeling ok with the car since he paid about $10k less than the asking price from Pelican including buyer’s premium. Although antithetical to our original discussion with this car, I wasn’t going to criticize the decision as it was already a done deal.

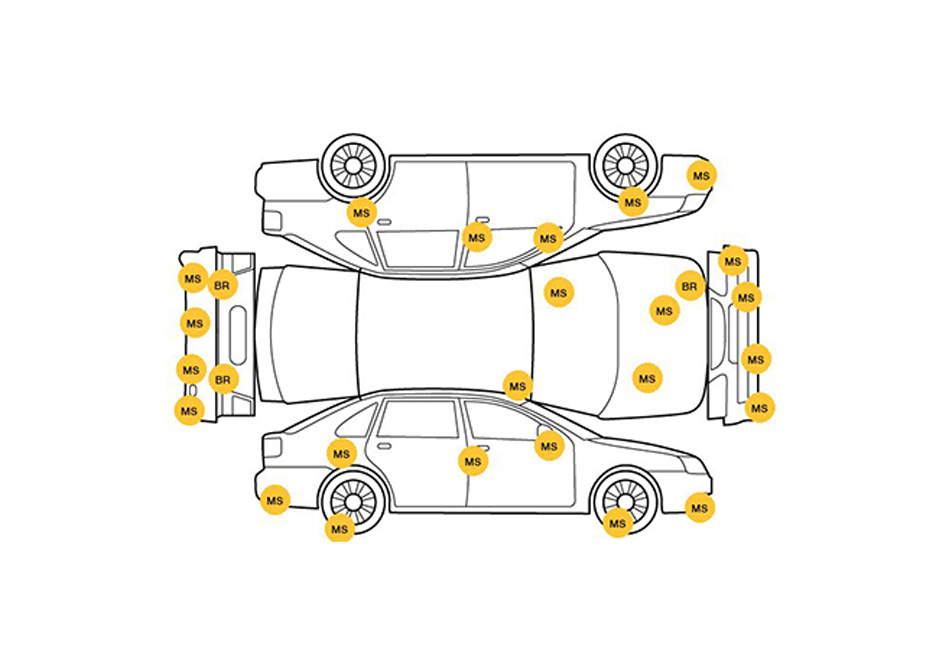

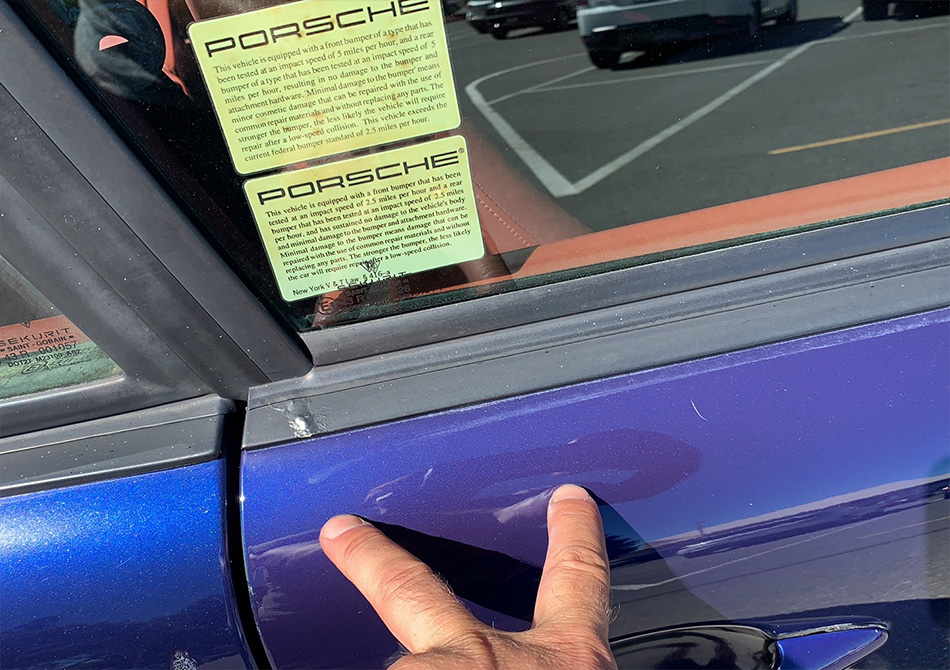

The first sign of real trouble was when the shipper sent over the bill of lading. I’ve bought a number of cars and had them shipped, and usually these bills of lading have a few spots marked on the illustration – not like the one below. Then looking at the photos the shipper sent, there’s clearly discoloration of the paint in multiple locations that weren’t apparent in either the original BAT or PCarMarket listing.

So now he’s looking at a repaint which will be in the neighborhood of $20k. He could opt for painting the front and rear bumpers and painting the areas that show a difference in color. But by that time, at least half the car would require painting and he’d still have 50 shades of blue.

The latest is that the bulk of his suspension is corroded requiring new struts all around, a rebuilding of CV joints, sway bar bushings, control arm tow link, brake rotors, and that’s just the running list.

Needless to say, it’s going to far more expensive to bring this car up to snuff than originally anticipated.

Yes you can say some obvious mistakes were made like buying the cheapest one and not getting a PPI. But we’re talking about an IT professional who had no qualms performing a PPI on cars sourced from dealers, so how did this purchase go so wrong?

I think the first problem was losing patience. Buying the right car is not an easy process and can often take months when looking for the right 25+ year old one. We’re not talking about buying a 3-year old off lease car with a clean CarFax. Buying a prospective classic like this each will pose their own story whether cosmetic, mechanical, or something else. And this brings us to the first issue with buying from an auction site.

It’s too easy for the seller to control the narrative when listing a car. The seller only provides information the site requires and has final sign off on the description of the car. The seller isn’t required to use an independent photographer. Taking pictures in the shade or at the right angles can easily mask cosmetic problems, not to mention purposefully withholding photos of small rock chips or something more insidious. Do we really trust cold start up videos? You could place your hand on a hot (but not scorching) manifold or exhaust to make it look like a cold start.

Seeing a stack of records in photos isn’t completely telling aside from seeing a stack of records. Are they arranged in a way that one can see annual maintenance was performed ritualistically or that all records are there? Can you even read all the text? Do you have a checklist of all the items you should be looking for, and if it’s not listed, does that become a dealbreaker?

This brings us to our next point – the PPI (pre-purchase inspection). If you’re considering a car a week out from its end date, you really don’t know exactly how much the car is going to sell for and if it will fit your budget. You could pay and arrange for a PPI during the week the car is for sale, but PPIs aren’t cheap. For a Porsche, it could easily run $500+ dollars, especially if you perform a compression and leak down test. Are you going to pay this bill for only a chance at winning an auction? The answer is most likely going to be no, so you’re reliant on the car community to point out flaws or ask the right questions. But again, if the narrative and listing is controlled by the seller, some things may be missed, and since no PPI was performed, those points won’t be factored into the end price.

With the countdown clock ticking and other prospective buyers competing for the same car, it makes it nearly impossible to do your due diligence. Auctions are designed for the buyer to spend more than their original budget. The overbidding mentality is that your new bid is only a few hundred more than your last one which was only a few hundred more than the one before that and so forth. Arguably this leads to sale prices higher than one would normally expect on the open market.

This isn’t to say there haven’t been successful transactions on these sites as there clearly have been. But for the reasons mentioned above, it requires a person with a tolerance for risk and deep pockets to complete a transaction without knowing what they’re buying.

What do you think? Leave your thoughts below.